Jakarta Insurance is actually a very important part, especially for micro, small, and medium enterprises (MSMEs). Unfortunately, many micro or MSME entrepreneurs still do not consider life insurance important, which can help in times of need.

Regarding this matter, BRI Life Insurance, in collaboration with the West Java Ornamental Plants and Horticulture Office, is striving to accelerate financial inclusion and literacy by providing protection in the form of Micro Insurance (AMKKM) to 35,224 farmers from 24 districts in the West Java Provincial Government.

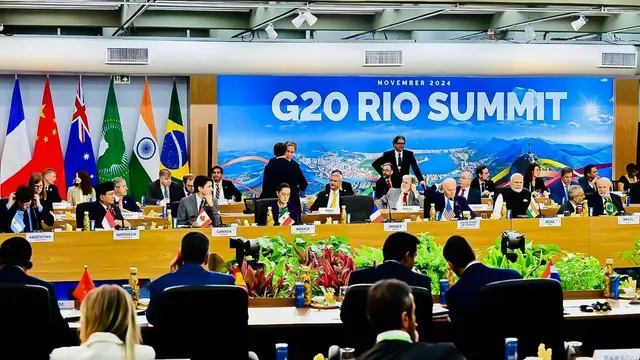

BRI Life’s Marketing Director, Sutadi, in his speech, said that insurance literacy among the lower-middle class society remains a significant challenge due to the many misconceptions surrounding it. “Therefore, BRI Life continues to strive to provide maximum education and insurance literacy to the community, which we are currently doing through collaboration with the Bandung Food Crops and Horticulture Office,” he said in a written statement on Wednesday (27/11/2024).

Sutadi explained that, through this collaboration, BRI Life provides protection in the form of Micro Insurance (AMKKM) to 35,224 farmers from 24 districts in the West Java Provincial Government with a total premium of Rp. 1.7 billion, offering benefits such as accident, health, and death protection.

“Additionally, this collaboration is also one of BRI Life’s efforts to develop and grow the BRI Group ecosystem by introducing BRILink Agents as a gateway for financial inclusion, especially insurance, to farmers and their families in West Java,” Sutadi said.

Leave a Reply