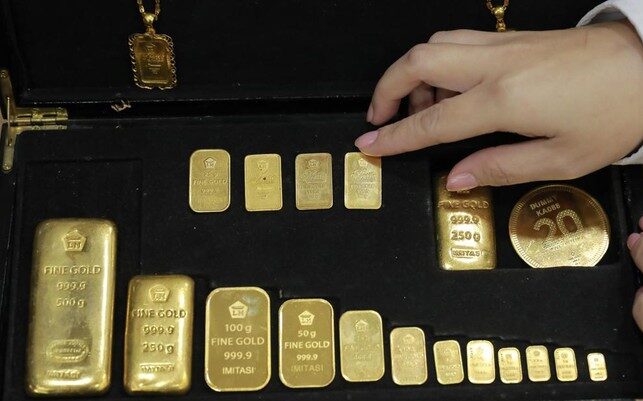

The price of Logam Mulia gold produced by PT Aneka Tambang Tbk on Friday (29/11/2024) at the LM Graha Dipta Pulo Gadung gold boutique was recorded at Rp1,508,000, a decrease of Rp5,000. Meanwhile, the buyback price (the price used when selling gold back) was at Rp1,356,000 per gram, also down by Rp5,000 compared to yesterday (28/11/2024).

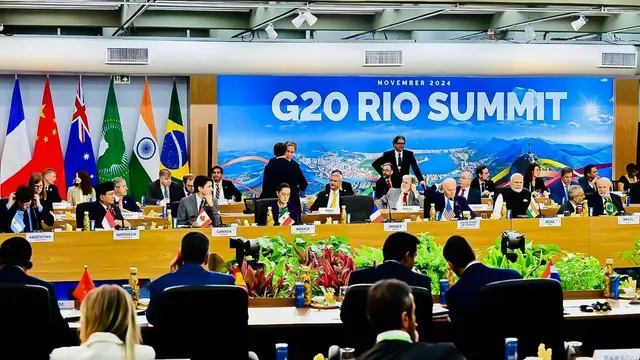

The decline in Antam’s gold price coincided with a slight decrease in the world gold price, which fell by 0.08% to US$2,638.87 per troy ounce this morning.

In his comments to Kitco News, Kelvin Wong, Senior Market Analyst at OANDA, said that although the long-term upward trend of gold remains intact, the precious metal is currently trapped in a medium-term corrective cycle.

Wong noted that changing market expectations regarding the monetary policy of the US central bank (The Fed) remain a growing obstacle for gold. Although the market continues to expect the US central bank to cut interest rates next month, there are increasing concerns that persistently high inflation could shorten the current policy easing cycle.

“Overall, the main upward trend phase for gold remains intact, driven by higher US budget deficits due to the upcoming major corporate tax cuts from Trump and the risk of stagflation from the potential trade war between the US and other countries,” he said.

However, Wong also warned that gold prices could continue to decline in the near future.

Antam Gold Price List (Rp)

Leave a Reply