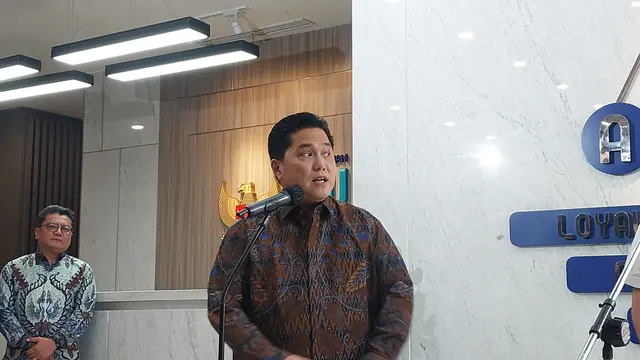

Jakarta – State-Owned Enterprises Minister Erick Thohir plans to meet with MSME Minister Maman Abdurrahman. The two will discuss the elimination of non-performing loans for MSMEs.

It is known that the removal of non-performing loans is being carried out to reopen credit access for MSMEs. The hope is that it can increase production capacity and elevate MSMEs to a higher level.

Erick recounted that initially, Maman was supposed to meet with him at the beginning of this week. However, the plan did not go ahead.

“Yesterday, the Minister of MSMEs was supposed to come, but he happened to be called away,” said Erick at the Ministry of State-Owned Enterprises office in Jakarta, quoted on Wednesday (11/12/2024).

He said that the plan is to discuss the elimination of non-performing loans for MSMEs. Considering that most of the non-performing loans for MSMEs are in the Himpunan Bank Negara (Himbara) or state-owned banks.

“So we will sit down to also discuss the step-by-step or measures regarding the write-off of non-performing loans,” said Erick.

In addition, he will also discuss the development of MSMEs in accordance with President Prabowo Subianto’s orders. “As mentioned yesterday by the President regarding MSMEs. So there is Himbara’s book but also MSMEs,” he concluded.

Erase Bad Debt Book

The Ministry of Micro, Small, and Medium Enterprises (MSMEs) emphasizes that the write-off of bad debts for MSMEs only applies to MSME entrepreneurs who are already on the write-off list.

The process of writing off bad debts for MSMEs can be completed by April 2025 in accordance with Government Regulation (PP) Number 47 of 2024 concerning the Write-Off of Bad Debts for MSMEs.

Minister of MSMEs Maman Abdurrahman stated that the policy of writing off bad debts only applies to MSMEs that are on the list of write-offs by state-owned banks (BUMN) or Himbara banks. Once they fall into the write-off category, BUMN banks can cancel the credit claims of MSME actors. The number of MSMEs in this category reaches hundreds of thousands.

UMKM entrepreneurs

“Don’t let this be interpreted by all MSME entrepreneurs that this policy applies to everyone. This only applies to MSME entrepreneurs who are already on the write-off list,” said Maman during a working meeting with Commission VII of the Indonesian House of Representatives (DPR RI) in Jakarta, Tuesday, (19/11/2024) as quoted from Antara.

Maman explained that the process of writing off bad debts currently still needs to wait for the General Meeting of Shareholders (GMS) of Himbara banks, which usually takes 45-60 days. The Ministry of SMEs hopes that the GMS can be expedited to 10 days and that the banks will immediately set the debt write-off quota.

In an effort to expedite the write-off of bad debts, the Ministry of Cooperatives and Small and Medium Enterprises (UMKM) has mapped out several steps to be taken, which include data collection of business actors in the plantation, agriculture, fisheries, maritime, and fashion and culinary industries; coordination with Himbara banks, public service agencies (BLU), Bank Indonesia, and the Financial Services Authority (OJK). (OJK).

Next, the formation of a team consisting of the Ministry of Cooperatives and Small and Medium Enterprises, the Ministry of Finance, the Ministry of State-Owned Enterprises, the Ministry of Agriculture, the Ministry of Maritime Affairs and Fisheries, as well as Bank Indonesia and the Financial Services Authority.

Leave a Reply