The increase in the Value Added Tax (VAT) rate to 12% planned by the government for 2025 has drawn criticism from various elements of society, including hotel and restaurant entrepreneurs.

The Secretary-General of the Indonesian Hotel and Restaurant Association (PHRI), Maulana Yusran, believes that this policy is untimely and has the potential to threaten the recovery of the hotel and restaurant sector, which is still struggling post-Covid-19 pandemic.

According to Yusran, the increase in VAT will impact hotel room rates and the prices that restaurant consumers have to pay. Although it is dynamic, he added, the pressure of rising operational costs makes price increases unavoidable. Because, he explained, hotels and restaurants have such extensive supply chains, including food and other basic necessities.

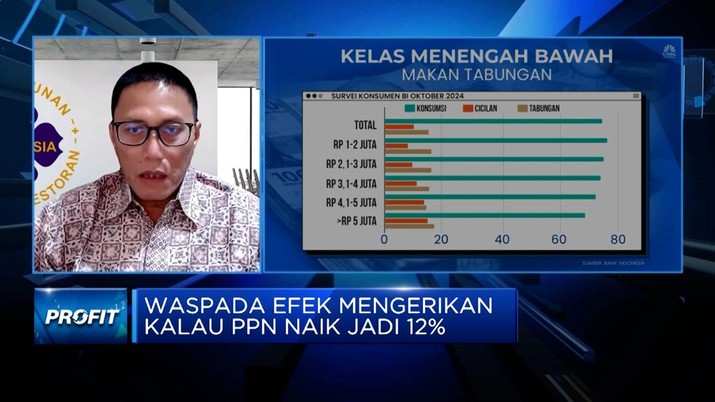

Therefore, he urged the government to reconsider this policy so that it does not become counterproductive to economic recovery. Moreover, with the purchasing power of the people not yet recovered, the increase in VAT could potentially weaken the tourism sector, which is one of the drivers of the national economy.

“The 12% increase in VAT, in our opinion, is not appropriate at this time.” Because the current economic condition is that our purchasing power is low and declining. Meanwhile, we in the tourism sector really need the purchasing power of the community to be well-maintained.

What we are most concerned about is the purchasing power itself. So if purchasing power continues to decline, the demand for hotels and restaurants will inevitably be affected. “Because a 1-point increase directly impacts the community,” said Maulana.

“The essentials for hotels include amenities, as well as the needs for food and beverages, the basic ingredients for food and beverages, and many other components that trigger price increases within that sector.” If prices rise, the number of consumers may not remain the same. Especially since the purchasing power of the people is still a major issue,” he added.

The increase in VAT, he continued, will further burden the public and potentially weaken tourist activities, especially domestic tourists who are currently the backbone of the tourism sector.

“Post-COVID-19, the tourism sector, especially the hotel and restaurant industry, has not yet reached its recovery point. So this makes it somewhat difficult for the tourism sector,” he said.

Maulana added that the 12% increase in VAT will have a direct impact on domestic tourists, who have been the main drivers of tourism recovery. With purchasing power continuously declining, tourists tend to limit their spending, including on vacations.

“This threatens the movement of domestic tourists, who we heavily rely on to stimulate each region,” he said.

Leave a Reply