The government is still formulating the right policy to fulfill the mandate of the Law on Harmonization of Tax Regulations (UU HPP), which sets the Value Added Tax (VAT) at 12% in January 2025.

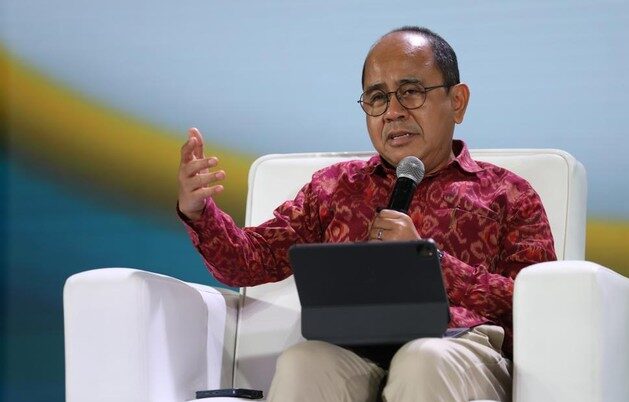

The Expert Staff of the Minister of Finance for Macroeconomics and International Finance, Parjiono, stated that the study on increasing the Value Added Tax (VAT) to 12% in January 2025 has actually been conducted for a long time. However, its realization seems difficult to achieve.

“We want to raise the VAT just a little, but it’s not easy, even though it has gone through a process that, if told, would be exhausting,” said Parjiono at the Sarasehan 100 Indonesian Economists event at Menara Bank Mega, Jakarta, Tuesday (3/12/2024).

As is known, the HPP Law itself, which mandates VAT to be 12% at the latest by January 2025, has indeed been established by the government and has been in effect since October 29, 2021. In the HPP Law, it is stipulated that VAT will increase periodically from 10% to 11% in 2022, and to 12% in 2025.

However, Parjiono emphasized that the government still considers the principle of tax justice, even though it acknowledges that no policy will satisfy all parties.

“Every policy will not satisfy all parties, in the end, that’s the point.” “But we were also very vocal during the G20, reminding Indonesia that during the G20, we taxed the super-rich who indeed bring great potential for us,” said Parjiono.

Parjiono emphasized that the government will certainly continue to focus on increasing the tax ratio against GDP. However, it will also maintain a conducive investment climate by providing measured fiscal incentives.

“For example, in the early days 10 years ago, there was a 50-year concession in Vietnam for FDI, we can’t go there either, right? So, of course, the taxation also has to be just right so that FDI doesn’t leave us,” said Parjiono.

“So, our bias is definitely towards our justice, but we shouldn’t collect more this year to achieve a 15% tax ratio, only for next year to lose all of it, with FDI running away. So, we also need to consider the long term,” he emphasized.

Leave a Reply